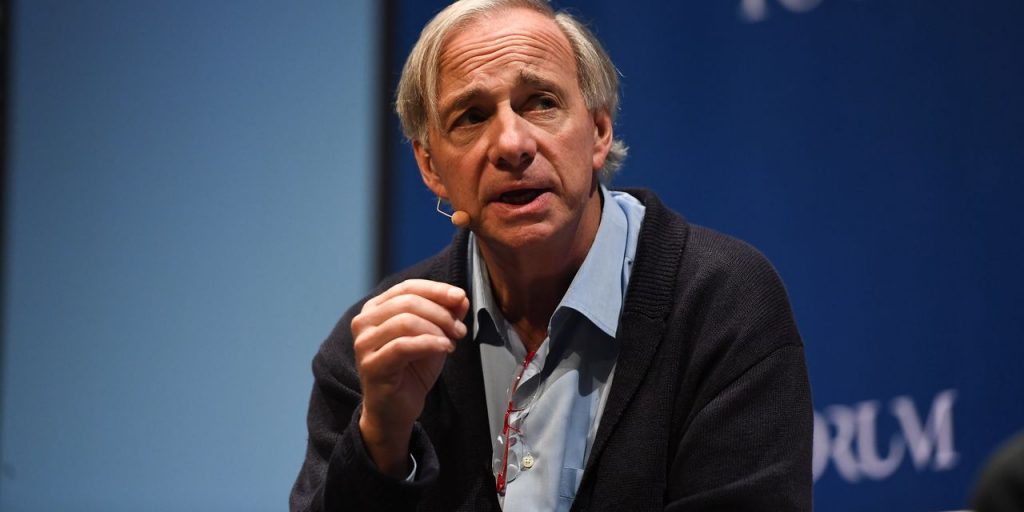

‘I have some bitcoin,’ says Dalio at crypto conference: ‘Personally, I’d rather have bitcoin than a bond’

Billionaire hedge-fund director Ray Dalio has shown that he possesses a few bitcoin, which makes the elite investor among the most recent conventional investors to announce possession in the planet’s hottest digital advantage.

The creator of Bridgewater Associates’s remarks suggests he could be gradually warming to bitcoin and cryptographic resources widely, which he’s previously expressed disbelief about.

‘Personally, I would rather have bitcoin compared to a bond,”’ Dalio told CoinDesk.

Authorities will wrestle with how to maintain control of their money and also the flow of cash and credit as cryptocurrencies compete as options across boundaries, based on Dalio, who proposed holding a diversified portfolio of crypto.

He explained of competing alternative monies.

Back in November, Dalio indicated he was skeptical about the usefulness of resources such as bitcoin BTCUSD, +10.32% and Ethereum ETHUSD, +20.03percent , the world’s No. two most notable crypto.

In a succession of tweets roughly six months before, Dalio introduced what he described as his’easy’ issues with bitcoin, such as his perspective the electronic advantage is too volatile and is not’very good as a medium of trade’ or a store of value.

Dalio did not say during the new CoinDesk interview just how much he possesses in bitcoin. Additionally, it might be possible that his investment is merely a means for him to understand an advantage he has criticized before.

However, his current remarks do indicate he is becoming less stridently opposed to bitcoin and its ilk.

Before this month, Dalio appeared a bullish tone to get crypto assets, stating that the largest hazard was’its achievement.’ He explained this notion for bitcoin throughout the CoinDesk interview also stated the ideal cryptocurrency for people might not be the best ones for authorities.

Dalio, a dominant figure in the realm of finance, has a networth of $20.3 billion, based on Forbes.