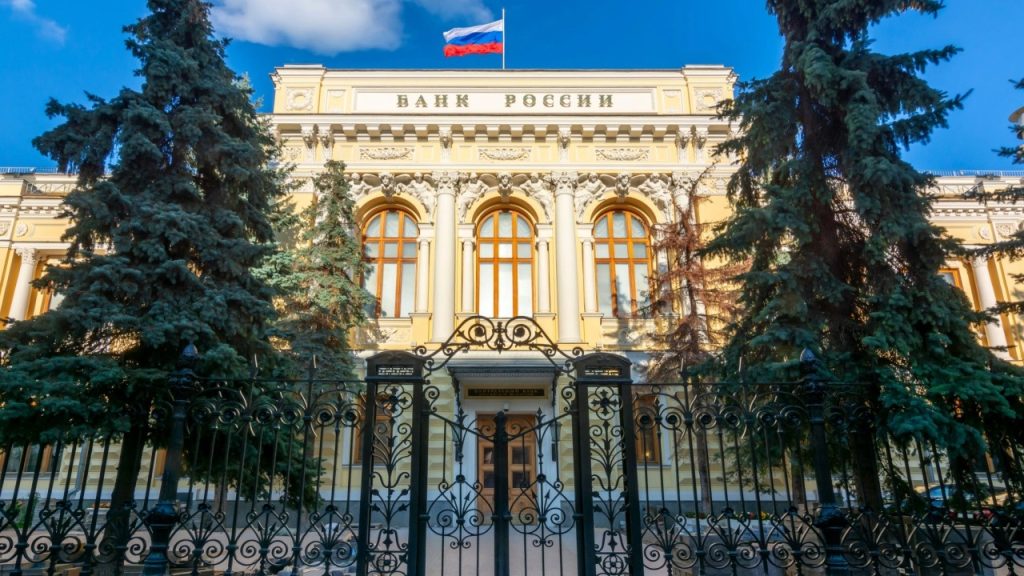

Bank of Russia Sets Out to Regulate Digital Asset Taxation, Exchange, Still Opposed to Crypto

The Central Bank of the Russian Federation (CBR), plans to file a legislative package regarding the regulation of digital financial asset (DFAs) at the State Duma (the lower house of parliament). According to Russian law, DFA is a term that refers to coins or tokens issued by an issuing entity and not cryptocurrencies such as bitcoin.

The bank’s deputy chairman Olga Skorobogatova spoke at Finopolis, an event devoted to financial innovation. She explained that the proposals are aimed at three main goals: improving taxation and eliminating tax arbitrage; developing exchange platforms and regulating smart contract.

CBR’s executive highlighted Russia’s strong interest in DFA development. According to Forklog, she stated that “We believe this is a very useful new tool for financial markets participants.”

Skorobogatova said that nine applications were being reviewed by the monetary authority to be granted a license to issue or circulate digital financial assets. She noted that three ‘information system operators’, Sberbank and Atomyze, have been authorized to do so.

Bank of Russia Resists Legalization of Cryptocurrency Settlements

Elvira Nabiullina, CBR Governor, stated in the Duma that although the Bank of Russia supports digital assets development, it opposes the use of private cryptocurrency in settlements. Tass news agency quoted her as saying that digital financial assets do not only include crypto.

We remain firm in our belief that private cryptocurrencies should not be used for settlements. It is unclear who or what is responsible. They are opaque and can pose high volatility risks.

Since over a year, discussions on the state of cryptocurrencies in Russia and regulation of the cryptocurrency market in Russia are ongoing. CBR has always maintained a strict stance and proposed a blanket prohibition on related activities like trading and mining in January.

However, sanctions imposed by the international payment authorities due to the conflict in Ukraine have softened their position. The monetary authority and the finance ministry agreed in September that Russia would not be able to make cross-border payments in cryptocurrency under current circumstances.